Reprint of article from July 2003 – as we come to the end of a tough set of COVID years: And speaking of Independence Day …. I just got off the phone with a friend. She’s decided to file bankruptcy. This was a very long road for her. Like other friends, she’s a very moral […]

Category Archives: *Special Reports

Subtitle: Playing 10 Questions with California’s Employment Development Department about How to Onboard Former Freelancers Since the California Legislature passed Assembly Bill 5 (AB5) in September of 2019, the rules regard who is and who is not an employee in this state have gotten ever more stringent – and confusing. Why confusing? Because there […]

Don’t complain about the laws, helplessly. You can change them, or prevent proposed bills from becoming law by letting your elected officials know how you feel. Here’s how to reach the people who make laws and sign Executive Orders: � LINKS President Joe Biden If you […]

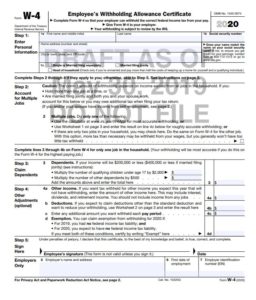

The IRS just released a draft of the Form W-4 that they a proposing to use for 2020.buy canadian tadalafil online https://mabvi.org/wp-content/languages/new/canadian/tadalafil.html no prescription https://mannadew.co.uk/wp-content/languages/new/viagra.html They came up with this after meeting with a national trade group of payroll tax processors – the folks who prepare the vast majority of payrolls and payroll tax returns […]

While working on a client’s tax return last month, I noticed that he was over 65. Still an active executive of a Fortune 100 company, his human resources department had informed him that he doesn’t need to file for Medicare, since he has full insurance coverage. Opps! That’s bad advice.

Intro paragraph: Employers – PLEASE PAY ATTENTION NOW! You can no longer get away with treating employees as freelancers. Aside from several recent court decisions, there are too many ways for your employees to turn you in to the IRS and state authorities. After all, if the employees don’t want to pay YOUR half of the […]

Meet Robbin and Armand D’Alo, EAs and Certified Divorce Financial Analysts (CDFA™) https://oaktreemediation.com/ They are authors of F-A-C-C-T: Understanding the truth about separation and divorce. Your first steps to a better life after marriage. Kindle Edition by Armand / Robbin D’Alo (Author)

Is Your Client an INVESTOR? a TRADER? or a MARK-TO-MARKET TRADER? ~ by Nancy E Goedecke, EA ~ The Internet has spawned a new breed of investors who use their computers to execute stock trades on a daily basis. Suddenly everyone and their cousin is either an online day trader or thinking about becoming […]

As with many things in life, we know we have to do them and we have to do them right and on time; filing tax returns ranks fairly high in this arena for many. In my own experience I have found that by finding some history or some context…

Your organization is doing good work, and has an important message to offer your community. But do-gooding is not enough for your local governments and tax boards: there are strict rules that must be followed:

The intricacies of nonprofit finance: solicitations, donations, gifts, pledges, 990, 1099, annuities, acknowledgements, meaningful budgets and reports make this topic rich with possibilities. You’re panting, now aren’t you?

Hi Eva, I was hoping that you could point me towards a place where I could learn more about incorporating small business’s. For a couple of years I’ve been sending people to lawyers to get incorporated and I’m tired of it. I incorporated my own business and my husband’s so I have a pretty good idea of […]