NEWS FLASH! Don’t panic. Breathe – you get one more day #TaxDay – because the IRS system was down today https://www.cpapracticeadvisor.com/news/12408362/irs-adds-one-day-to-tax-deadline-now-april-18-2018 Today is the tax return (or extension) filing deadline. The IRS’ entire electronic system is DOWN! Keep an eye on this page to see when it goes back up. Meanwhile, you cannot efile your […]

Category Archives: *Tax Quips

Today TaxMama® wants to talk about deadlines, extensions, payments and dealing with it all on a tight budget. What do you do first?!

Today TaxMama® hears from C in the TaxQuips forum. She has an all-too common problem. “I have a tax return that I completed but did not mail off from 2013, I know you have to process your taxes within 3 years, is there any way to mail off this 2013 tax return and get my […]

Today TaxMama® wants to give you something to think about before switching from employee status to independent contractor.

Last week, I promised you that the Legislature would pass an extender bill by spring. Well, good news! They didn’t wait that long. They included most of the provisions of S. 2256 in today’s budget bill. Alas, Congress only extended them for the short-term. All the extenders are retroactive to January 1, 2017. But the […]

Today TaxMama® realizes that this is the last day of January. There are some important things for you to know today.

Today TaxMama® wishes you a Happy New Year, and brings you some basics about how the Trump Tax Plan will affect this filing season.

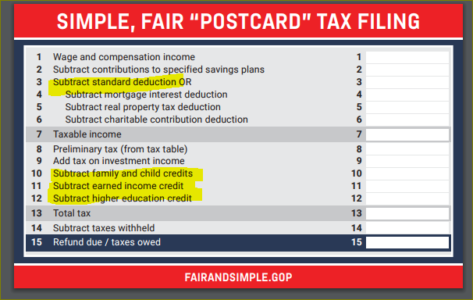

https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard. The bad news? Look at lines 3, 10, 11, and 12. Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality. It should be a required […]

News Flash: IRS just released 2018 mileage rates: 54.5 cents for every mile of business travel driven, up 1 cent from the rate for 2017. 18 cents per mile driven for medical or moving purposes, up 1 cent from the rate for 2017.buy temovate online drugeriemarket.co.uk/wp-content/languages/new/britain/temovate.html no prescription 14 cents per mile driven […]

Today TaxMama® hears from Bob with this question. “In order to rent my residence (house) as “unfurnished”, I had to move my furniture and other belongings to a storage facility (like Public Storage). Can I deduct the expense of this storage against my rental income?”

Dear TaxMama Family and Friends

Today TaxMama® wants to talk to you about the latest con games affecting people you know – especially seniors.