https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf

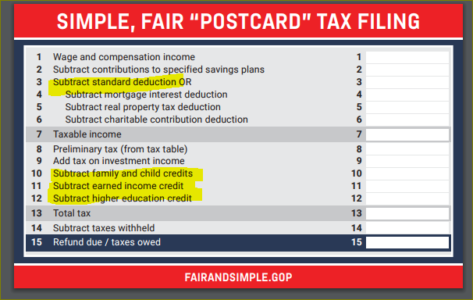

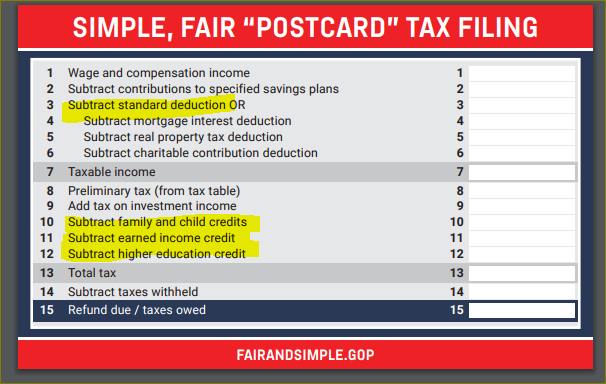

The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard.

The bad news? Look at lines 3, 10, 11, and 12.

Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality.

It should be a required pre-requisite for all lawmakers to prepare their own income tax returns before they are permitted to write, vote on, or pass legislation. I loved that episode of the short-lived TV series Mr. Sterling, where Senator Bill Sterling (Josh Brolin) is grumbling, trying to prepare his own tax return. Better yet, they should spent two weeks volunteering, or observing, at a VITA site to see how their tax laws truly affect low-income people’s tax filings.

In order for the IRS to accept a tax return with this information, you must first answer the questions on a two-page checklist. All online consumer and tax professional software includes this list. There is no way to include that information on the “postcard.” For 2017, the Form 8867 combines all the tax credits on lines 10 – 12. Next year, it will also include a column for HOH (line 3) .

The very people who would most readily qualify for this “postcard” are the ones who cannot use it.

All of the lines highlighted on this postcard are subject to tax fraud because these tax breaks create lower tax liabilities and refundable credits.

The standard deduction (line 3) is based on your filing status. The Head of Household (HOH) status is often used fraudulently by married couples who file separate tax returns. They use the HOH to reduce their tax bracket – and to claim refundable earned income credits that they wouldn’t get if they were to file jointly.

Refundable credits are funds given to the taxpayer even if they have not paid in any withholding or estimated taxes. Most credits just reduce the taxpayer’s tax liability. But refundable credits return exta money to the taxpayer from the U.S. Treasury’s coffers. So there is a long history of tax fraud. As a result, the IRS requires substantial additional verification of the taxpayers’ identities, relationships, and residencies before issuing these credits. There’s no room on the “Postcard” for all that.

Read on.

Line 10 – Claiming Family and Child Credits requires conformation about the child’s identity, age, relationship and residence. Schedule 8812 must be filed with the tax return – https://www.irs.gov/pub/irs-pdf/f1040s8.pdf

You may even need to send in proofs via Form 886-H-EIC – https://www.irs.gov/pub/irs-pdf/f886he.pdf

Line 11 – Claiming the Earned Income Credit – This is a huge potential source of refundable credits for low-income taxpayers with children. In 2017 it’s worth over $6,300 for a family with three qualifying children. That will increase with the new Tax Cuts and Jobs Act. Since it is SO subject to tax fraud and identity theft, taxpayers need to answer and include a 2-page Schedule EIC questionnaire with their tax returns.

Line 12 – Claiming the Higher Education Credit requires providing proof that the tuition was paid, the classes were taken, and that the credits were not claimed for too many years. In addition to proving the student was either the taxpayer or a qualified dependent.

It requires attaching a Form 8863 to the tax return https://www.irs.gov/pub/irs-pdf/f8863.pdf

and, possibly including the documents required on Form 886 https://www.irs.gov/pub/irs-pdf/f886haoc.pdf

Incidentally, ALL of these tax credits are reviewed by the IRS’ Criminal Investigation Division before refunds are issued. So all these refunds are held back for weeks, sometimes longer.

And that is why the postcard is a naïve, misguided fantasy – only raising the hopes of innocent taxpayers and voters.