Today TaxMama hears from Tom in Maryland, who is a tad befuddled. “what to do with a W-2 that includes income in Box 1…but there’s no reported SS wages, state income, or withholding of any kind. There’s a notation on the W-2 that reads, “Income subject to self-employment tax and must be reported on Schedule […]

Search Results for: W-2

Today TaxMama hears from Robert in Texas, who complains: “My employer fired me. I worked in the office and taxes were taken out of checks. She has not sent me my W-2 forms. What do I do now?”

Courtesy of the Internal Revenue Service TT 2008-24 Did you get your W-2? These documents are essential to filling out most individual tax returns. You should receive a Form W-2, Wage and Tax Statement, from each of your employers each year. Employers have until January 31, 2008 to provide or send you a 2007 W-2 […]

Today TaxMama hears from Bernie in New York, who’s quite frustrated.http://klassroom.co/files/migration/new/how-to-write-a-thesis-essay.html “My ex-wife and I are working on funding our child’s college education.http://klassroom.co/files/migration/new/how-to-write-analytical-paper.html How can I find out if her ,000 W-2 is complete and honest?buy diflucan online jersey-hemp.com/wp-content/languages/new/online/diflucan.html no prescription Her husband is showing her as his company’s secretary at this reduced income level. […]

Hi! It’s TaxQuips time from TaxMama.buy canadian prednisone online https://mabvi.org/wp-content/languages/new/canadian/prednisone.html no prescription com. Today TaxMama hears from Glenn in NY who tells us, “I have a question about W-2s and how they are compiled. I ask because there is a discrepancy between my year-end payroll stub and my W-2. The total on my W-2 was […]

Let me explain why this is important from a tax reporting perspective.

A business can deduct all its legitimate operating expenses from the business’ sales and income – either on a Schedule C, or a business entity return (partnership, corporaton, etc.) and deduct losses, as appropriate.

However, with a hobby, you must report all your income (on Schedule 1) – but you may not deduct your opertating expenses at all. Nowhere. Not on any form. The only thing you may deduct are your cost of goods sold. In other words, hobbyists that lose money don’t get to deduct expenses OR losses.

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about some questions people have asked TaxMama® after making major financial moves and ending up with extra taxes – or none of the tax breaks they were counting on. Dear Family, Well, we’ve survived the April 18th deadline! Many […]

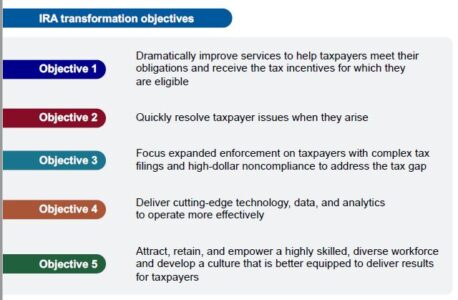

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about the new IRS Strategic Plan for using the $80 billon budget effectively – based on feedback they have received . Dear Family, Last week the IRS released their 150 page strategic plan on […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about errors people have been making in their tax returns this year. Dear Family, My goodness, it’s already Spring! The first day, here in Southern California is mostly gray, threatening to rain…but not quite making […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to suggest that you get advice FIRST before making major financial moves. Dear Family, Let’s start with the big thing this weekend – changing the clocks to Daylight Savings Time. Remember the old adage “Fall back; spring forward.” […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to alert you to issues that will affect your tax return filing, and perhaps tax planning, during 2023 Dear Family, Where does the time go?! Sorry to be posting so late – but the days just seem to flash […]

It’s TaxQuips time from TaxMama.com® Today TaxMama® wants to talk to you about filing your tax return before you have all the information and to address all the money you’re going to need by April 18th . Dear Family, STOP! PLEASE, PLEASE STOP! TaxMama® is getting […]