It’s TaxQuips time from TaxMama.com® .

Today TaxMama® wants to talk to you about the new IRS Strategic Plan for using the $80 billon budget effectively – based on feedback they have received .

Dear Family,

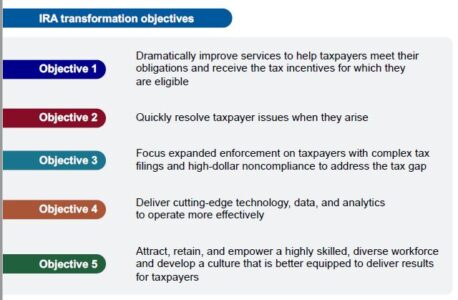

Last week the IRS released their 150 page strategic plan on how to use their $80 billion allocation over the next 10 years. The plan has 5 objectives:

- Dramatically improve services to help taxpayers meet their obligations and receive the tax incentives for which they are eligible.

- Quickly resolve taxpayer issues when they arise.

- Focus expanded enforcement on taxpayers with complex tax filings and high-dollar noncompliance to address the tax gap.

- Deliver cutting-edge technology, data, and analytics to operate more effectively.

- Attract, retain, and empower a highly skilled, diverse workforce and develop a culture that is better equipped to deliver results for taxpayers.

Naturally, some people will not be happy with the more aggressive focus on catching higher income tax evaders, non-payers and those who under-report their income. Using “Big Data” and more intensive training for IRS enforcement staff, the IRS will be better able to audit complex businesses with multiple layers of ownership, which are potentially designed to thwart scrutiny.

The good news is that there will not be an increased focus on taxpayers with under $400,000 in income. Their audit rates will not rise above historical levels.

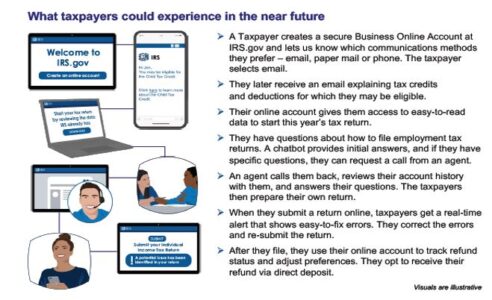

There is a great deal of emphasis on improving and updating computer systems and apps, improving customer service, and providing more online, self-help tools. This will reduce the long waits on telephone calls – and will increase taxpayers’ ability to access data, upload responses, set up payment plans, and more. Some of these tools are already available and growing. Others, we have been begging the IRS to make available for years.

You may notice in this IRS graphic, that they are talking about having an IRS agent call people back.

When it comes to IRS notices, their plan is to start by issuing “soft” notices providing tools for taxpayers to respond and “self-correct.” Using electronic communications to reduce the need for audits.

The good news about these calls and electronic notices is that, properly handled, they will make our lives easier.

The bad news is – taxpayers are already getting phishing emails and calls. So how will we be able to determine which ones really are from the IRS – and which are identity thieves?

They are also investing about $15 million in trying to create a way for taxpayers to file their tax returns directly with the IRS. As you can imagine that faces strong resistance from the major tax software houses – and perhaps tax professionals.

But when it comes to tax professionals, EAs, CPAs and Attorneys have long been aware that the need for our services by clients with simple tax returns (like only W-2s and interest and dividends) is phasing out, as taxpayers get more familiar with tax software.

Overall, taxpayers of the future would be wise to join the “app” age. We’re going to need to get more familiar with online tools, apps for phones and tablets, and how to scan documents, create PDFs and upload and download data – in order to use the IRS self-help tools most effectively. In addition, the IRS is expanding the way we will be able to pay online, via bank accounts, credit card, debit card, and NEW – digital wallets.

Incidentally, the IRS is hiring – all over the country. You may want to consider applying!

And remember, you can find answers to all kinds of questions about taxes and business issues, and EA Education, free. Where? Where else? At http://iTaxMama.com/AskQuestion

To make comments, please drop into the TaxQuips Forum.