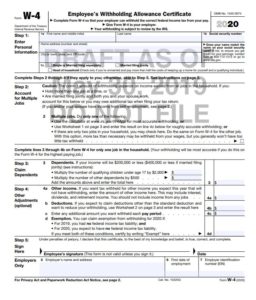

The IRS just released a draft of the Form W-4 that they a proposing to use for 2020.buy canadian tadalafil online https://mabvi.org/wp-content/languages/new/canadian/tadalafil.html no prescription https://mannadew.co.uk/wp-content/languages/new/viagra.html They came up with this after meeting with a national trade group of payroll tax processors – the folks who prepare the vast majority of payrolls and payroll tax returns […]

Category Archives: *AskTaxMama Newsletter

AskTaxMama

Lately, TaxMama® has been getting questions from tax professionals about clients who have moved out of the U.S. and have not filed tax returns. Those folks are now in deep trouble. Dear Family, If you have American family, friends or associates living or working outside the United States, please check with them immediately. Make sure […]

Photo by jaingolfsland Last week, TaxMama® visited the IRS, at our Practitioner Stakeholder Liaison meeting. Here is a brief summary of our six-hour session. Dear Family, Believe it or not, one of my favorite activities is spending time with the IRS. Over the years, the terrifying auditors and collections officers become real people I […]

*AskTaxMama Newsletter, *Tax Quips, Auto Expenses, Back-Up Withholding, Bankruptcy, Business, Depreciation, Employer ID Number, Estimated Taxes, Exempt Organizations, IRS News, ITIN, Non-Profit, Non-Profits, Sec 199A - Small Business Income Deduction, Social Security and SSDI, SSNs, Withholding

Small Business Week

TaxMama® welcomes you to Small Business Week! The IRS has been sending out all kinds of helpful information. (You know – I’m from the IRS and I’m here to help you!) Dear Family, It is, indeed, Small Business Week. And since many of you own your business, or run a business or profitable hobby […]

TaxMama® is hearing from readers or friends about things they left off their tax returns, or errors they made in the course of filing…perhaps a little too soon. Dear Family, TaxMama® is a big proponent of the “slow-down” philosophy. Use the extension. Take the time to review the tax return and the information in it […]

While working on a client’s tax return last month, I noticed that he was over 65. Still an active executive of a Fortune 100 company, his human resources department had informed him that he doesn’t need to file for Medicare, since he has full insurance coverage. Opps! That’s bad advice.

Today is a day of deadlines – important ones. So please pay attention!

Myth-busting–Filing an extension does not increase your audit risk.

Let’s just clear up some myths about LLCs and the rush to make entity changes. Here are the high points:

___________________________________________________________ Just a quick note to alert you to some deadlines. Sunday, March 10th – Daylight Savings starts – move your clocks forward Friday, March 15th – Webinar – Everything you Wanted to Know about the EA Exam 2019 March 15 10:00 am Pacific https://iTaxMama.com/Everything_EA_March Friday, March 15th – LOTS of deadlines Partnership returns are […]

Today TaxMama® wants to alert you to a tax extender bill sitting in Congress. It’s the Tax Extender and Disaster Relief Act of 2019. Dear Family, Great news! The extender bill that Congress is working on will buy us two years of (relative) certainty about our tax lives. The provisions in this bill will extend […]

says you can breathe a sigh of relief. The U.S. government will stay open. The IRS is still funded. You, your family and friends, who work for the government will be able to continue to pay your living costs. Whew!

Well, the U.S. Government is finally back open – if for only three weeks. The IRS is driving along on all cylinders. But it’s really hard to get through to them or to the Taxpayer Advocate Service. So what’s a taxpayer to do?