TaxMama® learns something from a question about the required minimum distributions. Got to tell you about this! Dear Family, One of our readers asked about how to take a required minimum distribution from his IRA account, when the only asset in the account was one one-kilo gold bar. In order for you to […]

Author Archives: TaxMama

Eva Rosenberg joins Jim Blasingame to reveal how some people get in trouble when they incorporate, but don’t convert their financial business over to the new entity, including tax ID designations.buy acyclovir online mannadew.co.uk/wp-content/languages/new/uk/acyclovir.html no prescription [s3audio url=”https://zaicast.smallbusinessadvocate.com:8000/media/jbsba/2019/08/20190801-I.mp3″ /]

Eva Rosenberg joins Jim Blasingame to reveal that having someone designated to run your business affairs when you die only works if you’ve made it legal. Just assigning someone won’t work. [s3audio url=”https://zaicast.smallbusinessadvocate.com:8000/media/jbsba/2019/08/20190801-J.mp3″ /]

Eva Rosenberg joins Jim Blasingame to reveal new clarity from the IRS on who does and doesn’t qualify for the QBI provisions in the new tax law.https://libaifoundation.org/wp-content/languages/new/ivermectin.html [s3audio url=”https://zaicast.smallbusinessadvocate.com:8000/media/jbsba/2019/08/20190801-H.mp3″ /]

Tax questions can pop up any time of the year. When people need answers, they should start with Interactive Tax Assistant on IRS.gov. It’s a tool that provides answers to a many tax law questions. The taxpayer enters answers to a series of questions and the tool gives them a response based on those answers. Here are […]

TaxMama® wants to bring some pending and potential tax legislation to your attention, today. Dear Family, On June 14th, I told you about the Taxpayer First Act that was waiting to be signed by the President. He signed that bill into law on July 1st. But there is still a lot that needs to be […]

As you all know, we have been waiting for two pieces of tax legislation from Congress this year:

a) An extender act to reinstate some of the tax provisions that expired at the end of 2017 (mortgage insurance deduction, tuition and fees deduction, etc.)

b) A law giving the IRS specific authority to require paid tax preparers to actually know something about the tax laws and procedures. (Did you know that 46 states and the District of Columbia have absolutely no licensing or knowledge requirements for paid tax preparers?)

Well, this Bill provides neither of those eagerly-awaited bits of legislation. So what does the Taxpayer First Act do for you?

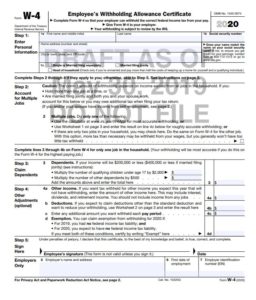

The IRS just released a draft of the Form W-4 that they a proposing to use for 2020.buy canadian tadalafil online https://mabvi.org/wp-content/languages/new/canadian/tadalafil.html no prescription https://mannadew.co.uk/wp-content/languages/new/viagra.html They came up with this after meeting with a national trade group of payroll tax processors – the folks who prepare the vast majority of payrolls and payroll tax returns […]

Lately, TaxMama® has been getting questions from tax professionals about clients who have moved out of the U.S. and have not filed tax returns. Those folks are now in deep trouble. Dear Family, If you have American family, friends or associates living or working outside the United States, please check with them immediately. Make sure […]

Photo by jaingolfsland Last week, TaxMama® visited the IRS, at our Practitioner Stakeholder Liaison meeting. Here is a brief summary of our six-hour session. Dear Family, Believe it or not, one of my favorite activities is spending time with the IRS. Over the years, the terrifying auditors and collections officers become real people I […]

*AskTaxMama Newsletter, *Tax Quips, Auto Expenses, Back-Up Withholding, Bankruptcy, Business, Depreciation, Employer ID Number, Estimated Taxes, Exempt Organizations, IRS News, ITIN, Non-Profit, Non-Profits, Sec 199A - Small Business Income Deduction, Social Security and SSDI, SSNs, Withholding

Small Business Week

TaxMama® welcomes you to Small Business Week! The IRS has been sending out all kinds of helpful information. (You know – I’m from the IRS and I’m here to help you!) Dear Family, It is, indeed, Small Business Week. And since many of you own your business, or run a business or profitable hobby […]

TaxMama® is hearing from readers or friends about things they left off their tax returns, or errors they made in the course of filing…perhaps a little too soon. Dear Family, TaxMama® is a big proponent of the “slow-down” philosophy. Use the extension. Take the time to review the tax return and the information in it […]