BREAKING NEWS – Marchh 20, 2020 – Treasury Secretary Steven Mnuchin tweeted Friday that President Trump has directed him to move Tax Day to July 15, giving taxpayers more time to file their taxes in the midst of the coronavirus pandemic. “At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15,” […]

Author Archives: TaxMama

Today TaxMama® wants to talk to you about the upcoming deadline on Monday. Yes, we do have an extra day, because the 15th is on a weekend. Dear Family, Coming up on Monday, here is what’s due: Form 1065 – Partnership tax returns and K-1s (for partnerships and LLCs […]

subtitle: Why donations are down – especially vehicles Today TaxMama® wants to talk to you about charitable contributions, especially vehicle donations. How are charitable donations of vehicles affected because of the new tax rules – effective as of December 2017, in the Tax Cuts and Jobs Act – https://www.irs.gov/charities-non-profits/charitable-organizations/irs-guidance-explains-rules-for-vehicle-donations ? The first tax […]

Today TaxMama® wants to talk to you about common errors people are making. Dear Family, We have been answering hundreds of questions from taxpayers and tax professionals in the TaxMama® Forum. https://iTaxMama.com/AskQuestion Oddly enough, people are upset with our answers. Why? Because they are asking questions AFTER they have […]

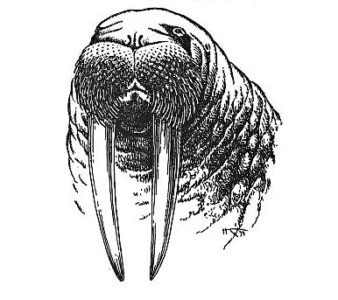

I am from the IRS and I am here to help you! The intention, believe it or not, is to help small businesses that start to get behind on payroll tax deposits – before they get so far behind that it’s too late to save the business. The fact is, one of the most common reason that small businesses fail (other than ineptitude, bad planning and lack of funds) is that the owner thinks it’s OK to use the money withheld from employees’ paychecks to pay their own bills, as a short-term loan. It might work once. But payroll after payroll, the boss starts getting more behind. The funds don’t get paid back. The payroll taxes don’t ever get deposited. This affects the employees, trying to get their refunds. This often causes businesses to go under.

Today TaxMama® wants to give you some very big news about tax law changes. On December 20th President Trump signed into law the Further Consolidated Appropriations Act. Those 715 pages included two major tax bills – the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) and the Taxpayer Certainty and Disaster […]

Today TaxMama® wants to give you news and some steps to take before the end of 2019. Dear Family, In the tax world, we spent this year trying to understand how to interpret all sorts of provisions of the Tax Cuts and Jobs Act that was passed at the last minute […]

Today, TaxMama® wants to talk to you about your delayed tax refund.

Eva Rosenberg joins Jim Blasingame to report on an IRS program that includes a visit to businesses that have fallen behind on their payroll tax filing and payments, but if that happens, ask them to help you. [s3audio url=”https://zaicast.smallbusinessadvocate.com:8000/media/jbsba/2019/11/20191118-G.mp3″ /]

Eva Rosenberg joins Jim Blasingame to report on an IRS program that includes a visit to businesses that have fallen behind on their payroll tax filing and payments, but if that happens, ask them to help you. [s3audio url=”https://zaicast.smallbusinessadvocate.com:8000/media/jbsba/2019/11/20191118-F.mp3″ /]

The time has come, TaxMama® said, to talk of many things. Filing deadlines, disaster extensions, and various confusions this year’s filing brings.

My friends, this is great news. These are excellent appointments. Sure, they know how to handle audits and collections – work with the “Small Business” taxpayer. But better than that – they also understand the taxpayer’s problems and issues and would prefer to help them prosper – or return to prosperity – than to shut […]