It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about how the IRS is spending some of the money they got from the Inflation Reduction Act Dear Family, When Congress granted the IRS about $80 billion dollars as part of the Inflation Reduction Act (IRA), I heard […]

Category Archives: IRS News

Let me explain why this is important from a tax reporting perspective.

A business can deduct all its legitimate operating expenses from the business’ sales and income – either on a Schedule C, or a business entity return (partnership, corporaton, etc.) and deduct losses, as appropriate.

However, with a hobby, you must report all your income (on Schedule 1) – but you may not deduct your opertating expenses at all. Nowhere. Not on any form. The only thing you may deduct are your cost of goods sold. In other words, hobbyists that lose money don’t get to deduct expenses OR losses.

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about some questions people have asked TaxMama® after making major financial moves and ending up with extra taxes – or none of the tax breaks they were counting on. Dear Family, Well, we’ve survived the April 18th deadline! Many […]

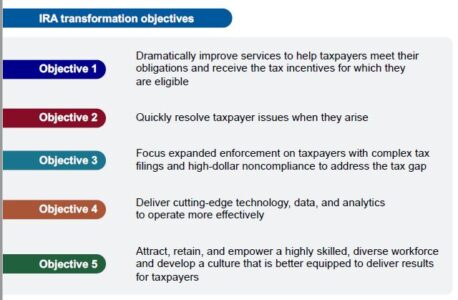

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about the new IRS Strategic Plan for using the $80 billon budget effectively – based on feedback they have received . Dear Family, Last week the IRS released their 150 page strategic plan on […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about errors people have been making in their tax returns this year. Dear Family, My goodness, it’s already Spring! The first day, here in Southern California is mostly gray, threatening to rain…but not quite making […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to suggest that you get advice FIRST before making major financial moves. Dear Family, Let’s start with the big thing this weekend – changing the clocks to Daylight Savings Time. Remember the old adage “Fall back; spring forward.” […]

Listen to the podcast here It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to let you know what kind of support you can expect from the IRS this year – if any. Dear Family, As you understand so well, since COVID19, it’s gotten harder than […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to alert you to issues that will affect your tax return filing, and perhaps tax planning, during 2023 Dear Family, Where does the time go?! Sorry to be posting so late – but the days just seem to flash […]

It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to alert you to some major tax news taking place before the year ends. Dear Family, As we come to the end of an incredibly busy year, there is still so much going on. Congress worked through the night to […]

TITLE: TaxMama® Tax Update 2022-2023 Subtitle: Summarizing the many Tax Acts related to 2022 – including 2022 and 2023 data for tax preparation and planning Speaker: Eva Rosenberg, EA, CTC, CTRS Webinar – using Zoom: Date: December 13, 2022 Time: 3:00 pm – 6:00 pm Pacific (Mountain: 4 – 7 PM MT / Central: […]

(Title – with apologies to the film – The Russians are Coming! The Russians are Coming!) It’s TaxQuips time from TaxMama.com® . Today TaxMama® wants to talk to you about the very last filing deadline for calendar year taxpayers filing 2021 tax returns. Dear Family, The time has come, the Walrus said, […]

Using Solo 401ks for your clients and you This is a special session for you before the extension period ends for Partnerships and S corps on how to set up and use a Solo 401k for your small business clients an yourselves. It’s also a month before the October 17th filing deadline for personal tax returns […]