Eva Rosenberg joins Jim Blasingame to reveal the many different tax records and remittances that are due soon, including how to manage your cash against the various obligations.buy zovirax online www.bodybuildingestore.com/wp-content/languages/new/engl/zovirax.html no prescription https://www.natas.co.uk/dev/wp-content/languages/new/how-to-write-an-essays.html

Author Archives: TaxMama

Eva Rosenberg joins Jim Blasingame to reveal when and how to comply with the various tax filing obligations, including when to consider using an extension, and how to use it properly. Find interviews with Small Business experts on the Small Business Advocate show

Today TaxMama® hears from C in the TaxQuips forum. She has an all-too common problem. “I have a tax return that I completed but did not mail off from 2013, I know you have to process your taxes within 3 years, is there any way to mail off this 2013 tax return and get my […]

Today TaxMama® wants to give you something to think about before switching from employee status to independent contractor.

Last week, I promised you that the Legislature would pass an extender bill by spring. Well, good news! They didn’t wait that long. They included most of the provisions of S. 2256 in today’s budget bill. Alas, Congress only extended them for the short-term. All the extenders are retroactive to January 1, 2017. But the […]

Today TaxMama® realizes that this is the last day of January. There are some important things for you to know today.

Eva Rosenberg joins Jim Blasingame to reveal what caused her to become an enrolled agent and tax expert. Find interviews with Small Business experts on the Small Business Advocate show

Eva Rosenberg joins Jim Blasingame to report on some of the tax changes that the new tax law will visit on small businesses, including a lot that the IRS will have to define later. Find interviews with Small Business experts on the Small Business Advocate show

Eva Rosenberg joins Jim Blasingame to report on the small business deduction that comes with many strings, qualifications and unresolved applications. Find interviews with Small Business experts on the Small Business Advocate show

Eva Rosenberg joins Jim Blasingame to report on some of the good elements of the new tax bill for small businesses, including accelerated expensing, but unlike for businesses, the individual alternative minimum tax is still there. Find interviews with Small Business experts on the Small Business Advocate show

Today TaxMama® wishes you a Happy New Year, and brings you some basics about how the Trump Tax Plan will affect this filing season.

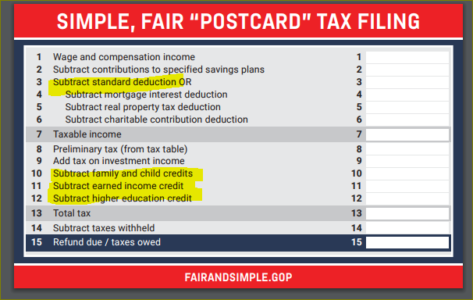

https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard. The bad news? Look at lines 3, 10, 11, and 12. Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality. It should be a required […]