It’s TaxQuips time from TaxMama.com® .

Today TaxMama® wants to alert you to issues that will affect your tax return filing, and perhaps tax planning, during 2023

Dear Family,

Where does the time go?!

Sorry to be posting so late – but the days just seem to flash by. Are you feeling the same sensation?

One reason each day is so full, is there are constant updates that I have to read, or learn about, several meetings with the IRS about systemic problems, and the IRS plans for this coming year, and, of course, answering your questions in the TaxMama® Forum. http://iTaxMama.com/AskQuestion . Remember, this is a totally complimentary resource for your benefit.

- You may have been hearing the IRS announcements about the CA Middle Class tax refund (from $400 – $1,050). Not taxable for California, but is it taxable for the IRS or not? Several of us have applied pressure on the IRS to give us an answer. Their announcements recommend not filing your tax return until the IRS does issue the announcement – so you don’t end up having to amend.

(Note: there may be similar issues with other states where 1099-MISC were issued by the state.) - The IRS’ $80 billion dollars – believe it or not, the IRS is asking stakeholders for their feedback on how to use this money most effectively. Please understand that this money will be disbursed over 10 years – not all at once.

Currently, this is the allocation they are showing:

- $ 3.181 billion – TAXPAYER SERVICES

- $45.637 billion – ENFORCEMENT

- $25.326 billion – OPERATIONS SUPPORT

- $ 4.750 billion – BUSINESS SYSTEMS MODERNIZATION

- One of the IRS national directors is holding 30 meetings around the country with tax professionals and associations, community leaders, various industry leaders and more. The goal is to learn each group’s recommendation for areas where they see the funds can improve customer service and functionality for their members. The IRS is actually interested in your feedback. So if you have a constructive suggestion on something specific that can be improved, please let me know as soon as possible and I will pass it along. (Seriously, don’t send me raves, political arguments, or nonsense.) Tell me about the problem you see – and recommend a sensible, practical solution.

Use this link please – in the TaxMama® Forum:

https://iTaxMama.com/IRS-80-Billion - In the meantime, you might be pleased to know that the IRS has hired lots of new phone staff (they are up to 4,000 right now) aiming for 5,000 by the end of the year.

- Some important things that changed for this year’s federal tax return:

- The filing deadline is April 18th

- For people in certain disaster areas in 2023, the deadline is as late as May 15th – that applies to IRA & HAS contributions as well,

- For people in certain disaster areas in 2022 – some can still file various 2021 and 2022 forms and make payments, without penalties, as late as February 15th and March 15th

- The Form 1040 has expanded the question about owning, using and trading cryptocurrencies. You are allowed to say NO, only if you owned the currencies, or bought them for cash, but had absolutely no transactions.

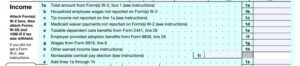

- Another change on page 1 of the Form 1040 – a few lines have been added in the “Wages” area, including a place to enter wages to household employees to whom you didn’t issue a form W-2.

- The filing deadline is April 18th

- The $300 charity deduction for people who don’t itemize – gone

- The huge child tax credit has dropped from $3,000 (or $3,600) per child in 2021 to $2,000 per child.

- AND where the full amount of this credit was refundable in 2021, only $1,500 per child is refundable in 2022.

- The child and dependent care credit – For 2021 Congress raised that to take into account child-care expenses of up to $8,000 per child – for up to two children. The maximum credit was $4,000 per child (50% of the cost). In 2021, the credit was refundable.

- For 2022, the original non-refundable credit is back – expenses are limited to $3,000 per child (up to 2 children.)

Tax Education

- As usual, I will be teaching a session at this year’s CSTC 2023 Tax Symposium in June. Please come and meet me in Las Vegas. If you tell me you’re coming, you’re invited to TaxMama’s® annual dinner on Monday night.

It’s time for Everything!

We have been getting a flood of questions about the 2023-2024 EA exam. So we will hold our first annual (complimentary) webinar – please clear some time on your calendar if you are interested in taking the IRS Exams this year.

Everything You Wanted to Know About the EA Exam,

but didn’t know who to ask:

Date: Thursday, March 2, 2023

Time: 10:00 am Pacific

For more information and no-charge sign-up:

https://iTaxMama.com/KickStart-TM

Incidentally, we are bribing you to join us. Anyone who stays for the entire presentation will get a $100 coupon off the price of the Premium class.

(If you have already signed up for the Premium class in 2023 – AND you sit through the entire presentation – we will send you a $100 refund.)

And remember, you can find answers to all kinds of questions about taxes and business issues, and EA Education, free. Where? Where else? At http://iTaxMama.com/AskQuestion