It’s TaxQuips time from TaxMama.com® – today TaxMama® wants to tell you about resources that are opening up for you on the IRS website. Dear Family, The IRS was busy last week, issuing announcements people have been waiting for about the advance payment of the Child Tax Credit this summer. The […]

Category Archives: *Tax Quips

It’s TaxQuips time from TaxMama.com® – Today TaxMama® wants to remind you about tomorrow’s due date – June 15th. Dear Family, With two topsy turvy tax years due to COVID19, it’s harder to keep track of deadlines. But, for the rest of this year, all deadlines are the same as they have been […]

It’s TaxQuips time from TaxMama.com® – today TaxMama® wants to give you some strategies or recommendations about how to deal with the retroactive changes from the American Rescue Act.

An Ode to April 15! Why is every year the same When we play this taxing game? “May 17th” turns out to be, something we couldn’t really foresee! With estimates still due on April 15. Folks do think the IRS is mean! Costs us more than just one night Making sure that all is […]

It’s TaxQuips time from TaxMama.com® – today TaxMama® wants to talk to you about the upcoming April 15th deadline – sort of… Dear Family, Well, we are one week away from the traditional filing deadline of April 15th. Do we still care? After all, the IRS moved the filing deadline […]

It’s TaxQuips time from TaxMama.com®. Today TaxMama® wants to talk to you about the nervous breakdown your tax professional is about to have. And why. Dear Family, I am extremely alarmed by what I am reading and seeing from the tax professional community – at all levels. From the […]

It’s TaxQuips time from TaxMama.com® – today TaxMama® wants to tell you a little bit about the new law – the American Rescue Plan Act – signed by the President yesterday. Dear Family, Well, people have been anticipating this new Tax Act eagerly, waiting to […]

It’s TaxQuips time from TaxMama.com® – today TaxMama® wants to talk to you about the sticker shock (high tax return balances) you just faced – and how to reduce some of that financial pain. Dear Family, There’s a lot going on right now, and new legislation about to be passed tomorrow. […]

When two people fall in love, they tend to be blind to life’s realities. The last thing they want to do is bring up issues that might generate conflict, and let’s face it, the topic of taxes is definitely turbulent. Ask these tough tax questions before you get married – to avoid an inevitable divorce. […]

Wow, an entire month has just flashed by. We’ve been buried in work at our office – how about yours? Dear Family, The 2020 tax return filing brings lots of questions, a certain amount of uncertainty, and for many Americans, a surprise balance due. (You didn’t realize […]

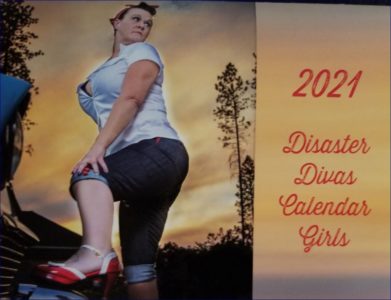

Whew! This has been an astonishing year. We still have new challenges to face in 2021. But look at what an inspiring group of women did to rise out of the ashes of a burned out town. The indomitable ladies in Paradise, California have pooled their spirits, resources and funds to help a woman who […]

We have legislation pending today – which might actually go through! Dear Family, Until some of the data released this morning, I didn’t think the new budget legislation was going to have any impact on our 2020 tax returns…but there are strong hints that aside from additional […]