People are starting see the checks in their bank accounts.

The IRS has opened BOTH portals – they are both found on this page:

https://www.irs.gov/coronavirus/economic-impact-payments

- For people who didn’t need to file but want to file a zero ($1) tax return to get their bank account info into the system

- For people who filed in 2019 or 2018, but didn’t have their bank account numbers on their tax return, for any number of reasons.

For what it’s worth, the portals are slooooooooooooooow…but functioning.

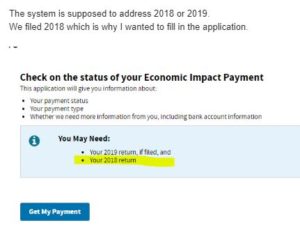

The (2) portal STILL doesn’t work for me. We always have our refunds applied to next year, so we don’t enter a bank account number.

We haven’t yet filed for 2019 – but have filed for 2018.

It gave me the same vague error message that many of you are getting – “Status Not Available”.

The IRS has updated their resources:

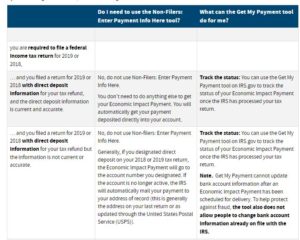

There’s new info on IRS.gov about Economic Impact Payments( EIP) that will answer a lot of your questions. The attached If/Then chart (the online version will be updated soon.) is also very handy.

The FAQs under EIP Information Center address the following:

- Eligibility

- Requesting My Economic Impact Payment

- Calculating My Economic Impact Payment

- Receiving My Payment

- More About the Economic Impact Payment

See the nifty chart from the IRS – there are many more details if you click the link.

A few days ago, I asked the IRS about the non-functioning resources:

This is what the IRS said about the two portals (and their updates, above):

The Get My Payment site is operating smoothly and effectively. As of mid-day today, more than 6.2 million taxpayers have successfully received their payment status and almost 1.1 million taxpayers have successfully provided banking information, ensuring a direct deposit will be quickly sent. IRS is actively monitoring site volume; if site volume gets too high, users are sent to an online “waiting room” for a brief wait until space becomes available, much like private sector online sites. Media reports saying the tool “crashed” are inaccurate.

In situations where payment status is not available, the app will respond with “Status Not Available”.

The IRS reminds users you may receive this message for one of the following reasons:

- If you are not eligible for a payment (see IRS.gov on who is eligible and who is not eligible)

[I am eligible!] - If you are required to file a tax return and have not filed in tax year 2018 or 2019.

[I DID file for 2018!]

If you recently filed your return or provided information through Non-Filers: Enter Your Payment Info on IRS.gov.

Your payment status will be updated when processing is completed.

- If you are a SSA or RRB Form 1099 recipient, SSI or VA benefit recipient –

the IRS is working with your agency to issue your payment; your information is not available in this app yet.

You can check the app again to see whether there has been an update to your information.

The IRS reminds taxpayers that Get My Payment data is updated once per day, so there’s no need to check back more frequently.

The IRS continues to closely monitor the situation. In addition, more information will be shared on IRS.gov shortly on some common questions taxpayers are asking.

The IRS also said this about Supplemental Security Income recipients;

They will receive automatic Economic Impact Payments; step follows work between Treasury, IRS, Social Security Administration.

The IRS clarified that SSI recipients will receive a $1,200 Economic Impact Payment with no further action needed on their part.

The IRS projects the payments for this group will go out no later than early May