It’s TaxQuips time from TaxMama.com® .

Today TaxMama® wants talk to you about an eclectic set of tidbits about IRS changes and news.

Dear Family,

Recently, the IRS started releasing updated Frequently Asked Questions (FAQs) about different topics. They didn’t actually add new information or change any procedures. But did add more clarifications (look for the updated date next to the FAQ):

The most important information for people still waiting for their 2020 and 2021 tax returns to be processed can be found in this FAQ. It tells you that your delay could be even longer than you could ever have imagined; to do nothing – just wait…and several other helpful tips.

Are you missing stimulus/recovery payments? Are you convinced you never received them, even though the IRS transcripts say you did?

- Use Form 3911 to track the payment.

- Save time and fax this request to the IRS to 855-332-3068

- Call 800-919-9835 to follow up

- But first! Look through all your bank accounts to be sure the payments are not there.

- And here’s a delightful twist to make you crazy. Did you pay for your tax software or tax preparation fee by having it deducted from your refund?

Your stimulus payments may have gone to bank that handled the fee payment to TurboTax, H&RBlock, etc., or to your tax pro. Oh no! That’s another place to inquire before filing your Form 3911.

Here are some other useful FAQs

- IRS revises FAQs for Tax Year 2021 Earned Income Tax Credit

- IRS revises 2021 Child Tax Credit and Advance Child Tax Credit frequently asked questions

What’s frustrating is that they don’t put the newest answers on top; or, on a page with 20 or more FAQs, it would be helpful to get a summary of which FAQs had changed. With links to those changed FAQs. (Remind me to suggest that to the IMRS team. They are the ones who convinced the IRS to show the dates of the changes.)

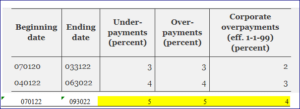

The IRS is raising interest rates on balances due. They have been pretty stable, at 3% until earlier in April of this year. With this 3rd quarter increase, the IRS will have raised the interest rate by 2% for the second 2 quarters.

This is good news for people with refunds that are delayed. But not for people owe money to the IRS.

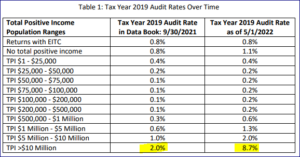

The IRS released their audit statistics for tax year 2019. As you can see, these audits are still in process. Look for your income bracket to see how likely you are to be selected. Audit rates have doubled for those in the $75,000 – $5 million range. Yet, they still remain well under 1% of the population.

Audits of those folks with incomes over $10 million have increased fourfold.(Believe it or not, the IRS has another set of statistics that shows the results of all these audits.)

Natural disasters are increasing. As we get ever more storms, floods, fires, hurricanes, tornadoes and other plagues, the IRS provides some tips to help you protect your financial data. These are things you can do now – before the next disaster hits your home.

Something no one seems to remind you about – your irreplaceable family documents, photographs, films – the memories and love that cannot be recreated if lost, stolen or damaged. Protect those! Load them someplace safe in the Cloud – perhaps copied into one or more different systems in case one of them gets hit with their own disaster. It’s inexpensive to be redundant about your most precious family treasures.

That’s it for now. There are many, many more questions in the TaxMama® Forum. Drop by and read – or ask your own. http://iTaxMama.com/AskQuestion

And remember, you can find answers to all kinds of questions about taxes and business issues, and EA Education, free. Where? Where else? At http://iTaxMama.com/AskQuestion

To make comments please drop into the TaxQuips Forum.