Please stay tuned here for updates from the IRS and other key news that affects your lives, currently.

We will be adding information to this page.

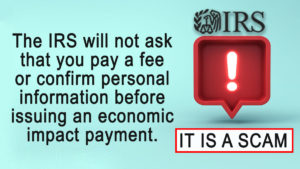

If you get such a call — HANG UP. See official updates at www.irs.gov/coronavirus

California update – CA changed their due date and payment date to match the IRS’.

Other states:

See the summary from the TaxFoundation.org, here – most have changed their due dates.

But not all have gone all the way to July 15th. Look up your state!

https://taxfoundation.org/state-tax-coronavirus-covid19

This question keeps coming up- see #16

What about the 2nd quarter estimated payment. Is that postponed, as well?A16. No, second quarter 2020 estimated income tax payments are still due on June 15, 2020. First quarter 2020 estimated income tax payments are postponed from April 15 to July 15, 2020.

IRS to Accept Email, Digital Signatures

To help taxpayers and the tax professional community during this COVID-19 period, effective immediately, the IRS will begin temporarily accepting images of signatures (scanned or photographed) and digital signatures on documents related to the determination or collection of tax liability.

In addition, the IRS is allowing IRS employees to accept documents via email and to transmit documents to taxpayers using SecureZip or other established secured messaging systems.

“The IRS is continuing to monitor methods to lessen the burden on taxpayers and professionals during this period,” said Sunita Lough, IRS Deputy Commissioner for Services and Enforcement. “We greatly appreciate the patience, support and valuable comments we continue to receive from the tax professional community as we move forward.”

This effort, described in an internal IRS memo, is in response to the Coronavirus situation maximizing the ability of the IRS to execute on mission-critical duties where employees, taxpayers and their representatives are working from alternate, remote locations outside their office.

The taxpayer or representative must include a statement, either in the form of an attached cover letter or within the body of the email, saying to the effect: “The attached [name of document] includes [name of taxpayer]’s valid signature and the taxpayer intends to transmit the attached document to the IRS.” The choice to transmit documents electronically is solely that of the taxpayer.

The limited categories of documents included in the scope of this effort include extensions of statute of limitations on assessment or collection, waivers of statutory notices of deficiency and consents to assessment, agreements to specific tax matters or tax liabilities (closing agreements), and any other statement or form needing the signature of a taxpayer or representative traditionally collected by IRS personnel outside of standard filing procedures (for example, a case specific Power of Attorney).

The IRS is continuing to review standards for e-signing other documents and invites suggestions and comments as it pursues additional efforts designed to lessen the burden on taxpayers and professionals during this period.