Today TaxMama hears from Aaron in the TaxQuips Forum, who wants to know. “Can I file taxes for 2008 on my own? If so what forms should I use? I was self employed and didn’t file an extension.”

Today TaxMama hears from Aaron in the TaxQuips Forum, who wants to know. “Can I file taxes for 2008 on my own? If so what forms should I use? I was self employed and didn’t file an extension.”

https://taxmama.wpengine.com/forum/taxquips/year-old-taxes

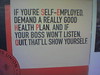

Rita Lewis replies to Aaron. Rita is an Enrolled Agent in Connecticut. She says, you can file taxes on your own for 2008 or any year. You might be wise to use a professional tax preparer if you don’t know what forms to use. Self-employment can have a number of schedules, worksheets, etc., so it might be a wise use of your time and money to sit down with a professional. Eva has an excellent book to help the self-employed. Small Business Taxes Made Easy https://taxmama.wpengine.com/small-business-taxes-made-easy/

However, 2008 is already late and accruing interest as well as penalties, if you owe.

Have you filed your 2009 taxes yet? Taking both years to a pro now probably means an extension for 2009 and the pro starting with 2008 after tax season. Also take a copy of your 2007 return with you.

TaxMama adds – But if you want to do it yourself, here are two companies that still have prior year software available: TaxAct and TaxCut (now, H&R Block @ Home). In fact, you can get it cheaply, new, from a number of sources by searching Google Products.

I cannot list all the different forms you are apt to need, since I know nothing about your business. So be sure to read IRS Publication 334 thoroughly before you start. It will answer many of your questions.

And remember, you can find answers to all kinds of questions being self-employed other tax issues, free. Where? Where else? At www.TaxMama.com.

[Note: If you were subscribed to the e-mailed TaxQuips, you’d be getting other exciting news and tips by e-mail, that never appear on the site. Please click on the join TaxMama.com link – it’s free!]Please post all Comments and Replies in the – New TaxQuips Forum

Comments are closed.