TaxMama® wants to bring some pending and potential tax legislation to your attention, today. Dear Family, On June 14th, I told you about the Taxpayer First Act that was waiting to be signed by the President. He signed that bill into law on July 1st. But there is still a lot that needs to be […]

Search Results for: tax deduction

As you all know, we have been waiting for two pieces of tax legislation from Congress this year:

a) An extender act to reinstate some of the tax provisions that expired at the end of 2017 (mortgage insurance deduction, tuition and fees deduction, etc.)

b) A law giving the IRS specific authority to require paid tax preparers to actually know something about the tax laws and procedures. (Did you know that 46 states and the District of Columbia have absolutely no licensing or knowledge requirements for paid tax preparers?)

Well, this Bill provides neither of those eagerly-awaited bits of legislation. So what does the Taxpayer First Act do for you?

Today is a day of deadlines – important ones. So please pay attention!

Myth-busting–Filing an extension does not increase your audit risk.

Well, the U.S. Government is finally back open – if for only three weeks. The IRS is driving along on all cylinders. But it’s really hard to get through to them or to the Taxpayer Advocate Service. So what’s a taxpayer to do?

Today TaxMama®wants to give you some steps to take before the end of 2018. Dear Family, This year, it’s especially difficult to figure out how to reduce your taxes. The average couple is not likely to be itemizing any more. Folks with high employee business expenses won’t be able to use them. Individuals with mortgages […]

Course Title: TaxMama® TCJA Planning Webinar subtitle: Tax Cuts and Jobs Act – Tax Planning for Small Businesses and Employees with Large, Unreimbursed Business Expenses Speaker: Eva Rosenberg, EA, CTC, CTRS Date and Time: On-Demand Cost: $99 (Free to TaxMama® Prime EA Students and TaxMama® Family Members) All full-pay registrations include a copy of the new […]

Today TaxMama® wants to update you on the Postcard Tax Form .

Last week, I promised you that the Legislature would pass an extender bill by spring. Well, good news! They didn’t wait that long. They included most of the provisions of S. 2256 in today’s budget bill. Alas, Congress only extended them for the short-term. All the extenders are retroactive to January 1, 2017. But the […]

Today TaxMama® realizes that this is the last day of January. There are some important things for you to know today.

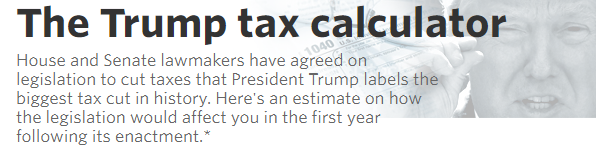

Today TaxMama® wishes you a Happy New Year, and brings you some basics about how the Trump Tax Plan will affect this filing season.

On November 2nd, the House Ways and Means Committee unveiled a sweeping tax bill, Tax Cut and Jobs Act, designed to undo many of the complexities of the Tax Reform Act of 1986. Please understand that this is not law yet. There’s still a long journey, with lots of hurdles, before some version of […]