Today TaxMama wants to talk to you about a two IRS interest rates that are important for you to understand.

Dear Family,

IRS just released the latest AFR report for August 2010. AFR stands for Applicable Federal Rate.

These are meant to be the lowest interest rates for related-party loans. That means, loans between family members, or between a business and its owners, shareholders or partners.

buy bactroban online https://tjurhat.com/evemedica/wp-content/languages/new/bactroban.html no prescription

The lowest rate for installment sales. Things like that.

This is also the interest rate IRS will use as income when you make a related party loan and don’t charge any interest at all. You will be paying tax on this phantom income. So you may as well write a proper loan in the first place.

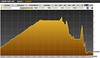

AFR rates are broken up by short-term, mid-term and long-term loans. Also, by how often payments are made: monthly, quarterly, semi-annually, or annually.

buy elavil online https://tjurhat.com/evemedica/wp-content/languages/new/elavil.html no prescription

Another set of interest rates important to you – and this extremely hard to find on the IRS site – are the rates IRS charges when you have a balance due; and the rates IRS pays you when you have a refund coming. The good news is you can find the list, regularly updated at SMBIZ.COM .

At the moment, underpayments of taxes will only cost you 4% per year. At this price, if you have to borrow money to cover your estimated tax payments, it may be cheaper (but unwise) to skip them – and just pay your taxes in April. New rates are announced each quarter, so keep an eye on the list.

This is also the source for interest payments when you owe IRS money over several years. IRS will compute your interest using the rate in effect for each quarter, during any period of time you have a balance due.

buy levaquin online cpff.ca/wp-content/languages/new/mg/levaquin.html no prescription

So if you owe taxes since 2007, your interest rates will range 8% to 4% during that time.

buy amoxil online https://tjurhat.com/evemedica/wp-content/languages/new/amoxil.html no prescription

And remember, you can find answers to all kinds of questions about IRS interest rates, and other tax issues, free. Where? Where else? At www.TaxMama.com.

[Note: If you were subscribed to the e-mailed TaxQuips, you’d be getting other exciting news and tips by e-mail, that never appear on the site. Please click on the join TaxMama.com link – it’s free!]Please post all Comments and Replies in the new TaxQuips Forum