Today TaxMama® hears from Asal in the TaxQuips Forum, who asks a simple question. “Did you know how many people in the United States owe back taxes?”

Yes Asal, I do.

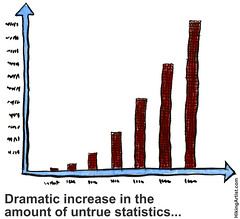

While I wait for Asal to expand on his question – or tell us what he really wants to know, let me tell you how to find fun information like that. At least, statistically speaking.

IRS has a nifty Data Book, where they record all kinds of interesting data – a year or 5 behind.

You just click on “Enforcement: Collections, Penalties, and Criminal Investigation” to find out about delinquent taxpayers. That takes you to Table 16 – Delinquent Collections Activities. And voila! You can find data for years from 1994 – 2011.

In fiscal year 2011, which ended on 06/30/2012, we learn:

1) Over 10.8 million taxpayers filed tax returns with unpaid balances that were still unpaid at the end of the fiscal year – up from nearly 10.4 million the year before.

2) There were nearly 3.9 million investigations of taxpayers with delinquent tax returns – up from 3.7 million the year before.

3) While over $28 billion was outstanding, the IRS collected nearly $2 billion worth of delinquent accounts

Naturally, if you spend time with this report, you can mine even more information from it. And if you delve into the full Data Book, you can immerse yourself in luscious tax statistics, data, reports and analyses. Who knows, if you really learn to understand it – perhaps YOU could be the one to save our country’s finances!

And remember, you can find answers to all kinds of questions about tax statistics and other tax and business issues, free. Where? Where else? At www.TaxMama.com.

[Note: If you were subscribed to the e-mailed version of TaxQuips, you’d be getting other exciting news and tips by e-mail, that never appear on the site. Please click on the join TaxMama.com link – it’s free!]Please post all Comments and Replies in the new TaxQuips Forum .