Today TaxMama® wants to update you on the Postcard Tax Form .

Dear Friends and Family,

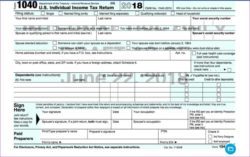

You’ve been hearing a lot of talk about the IRS’ new “postcard” tax return, designed for you to use in 2019. You can pick up copies of the form(s) here.

Let me clear up a few myths for you – and give you the nitty-gritty about how this will affect you.

- It’s not a postcard – so don’t worry about your personal information being exposed to the mail carrier, your mail box handlers, your neighbors, or anyone else.

- It is designed to be filed electronically.

- Not sure if it can be paper-filed, but it probably can.

- The proposed Form 1040 is designed to replace the 1040,1040A, 1040EZ). (Before realizing there were two pages, I was stunned.)

- This is not final. The IRS is accepting comments and will issue two more versions of this before it is finalized for filing season. To make your own comments, use this email address – WI.1040.Comments@IRS.gov

- The basic tax return has been reduced from 78 lines to 23 lines. All of the numerical data is on page 2.

- They have moved qualifying information regarding the standard deduction to the first page of this “postcard” – like

- being claimed as dependent by someone else

- being age 65 or over, or blind

- whether the spouse itemized on a separate return, or is a dual-status alien

- They have added a box, right in front, about having health insurance coverage for the full year. (Of course, if you had the coverage through the Marketplace, you still have to fill out Form 8962 to see if you have to pay any of that back.)

- There are 6 schedules that feed into this short form (see them here)

- -Schedule 1 Additional Income and Adjustments to Income

- -Schedule 2 Tax

- -Schedule 3 Non-refundable credits

- -Schedule 4 Other Taxes

- -Schedule 5 Other Payments and Refundable Credits

- -Schedule 6 Foreign Address and Third Party Designee

- You may have noticed that there is no schedule for itemized deductions. That’s OK, you can still use Schedule A and enter that information on line 8 of the “postcard.”

- Don’t worry about not being able to report your business, farm, rentals, or partnerships, depreciation, capital gains or losses – or other types of income. All those forms and schedules remain unchanged. They will flow through to Schedule 1.

- You haven’t lost the right to deduct your IRA, HSA, alimony or other above-the-line deductions. They also flow to Schedule 1.

- Where is that new 20% Qualified Business Income Deduction? It’s on line 9, right after the standard deductions (or itemized deductions) – just before the computation of taxable income.

- Your withholding appears directly on the “postcard’s” line 16. But you will need Schedule 5 to report your estimated tax payments, extension payments and refundable credits. Of course, for the refundable credits, you will still need all the detailed identity and qualifying information from the specific tax forms for the credit.

Overall, this will make it easier for people who have jobs, can use the standard deduction, and don’t have children who qualify for the child tax credit and earned income credit. This should cover about 30% of taxapyers.

The IRS estimates that 65% of taxpayers will only need one additional schedule. Which actually makes no sense. Why? Because people with children and/or students need at least two schedules to claim the refundable and non-refundable portions of the Child Tax Credit and the American Opportunity Credit. (Schedules 3 and 8) In other words, lower income taxpayers will still be providing the same complex information as ever.

For everyone else, nothing will really change. Your tax software, whether for professionals or consumers, will not change the inputs significantly. If you need to use the extra schedules or forms, your software will allow you to enter the information as you always have done it.

To make comments and toss in your own ideas, please drop into the TaxQuips Forum.

And remember, you can find answers to all kinds of questions about tax and business issues, free. Where? Where else? At www.TaxMama.com.

[Note: If you were subscribed to the e-mailed version of TaxQuips, you’d be getting other exciting news and tips by e-mail, that never appear on the site. Please click on the join TaxMama.com link – it’s free!]