Today TaxMama® hears from Rosemount in the TaxQuips Forum, with this excellent question. “What taxes would be due on municipal bond fund earnings if a Florida resident?”

Today TaxMama® hears from Rosemount in the TaxQuips Forum, with this excellent question. “What taxes would be due on municipal bond fund earnings if a Florida resident?”

Dear Rosemount,

As you probably know, Florida does not have any personal income taxes.

Unlike states, like NH that claim not to have taxes, but that tax interest and dividends.

So…let’s look at taxes from the IRS.

Typically, the IRS does not assess income taxes on Municipal Bond income.

However, if your income goes too high, you might face alternative minimum taxes.

You can find some answers to such questions here at InvestinginBonds.com.

They will give you some guidance before you start investing.

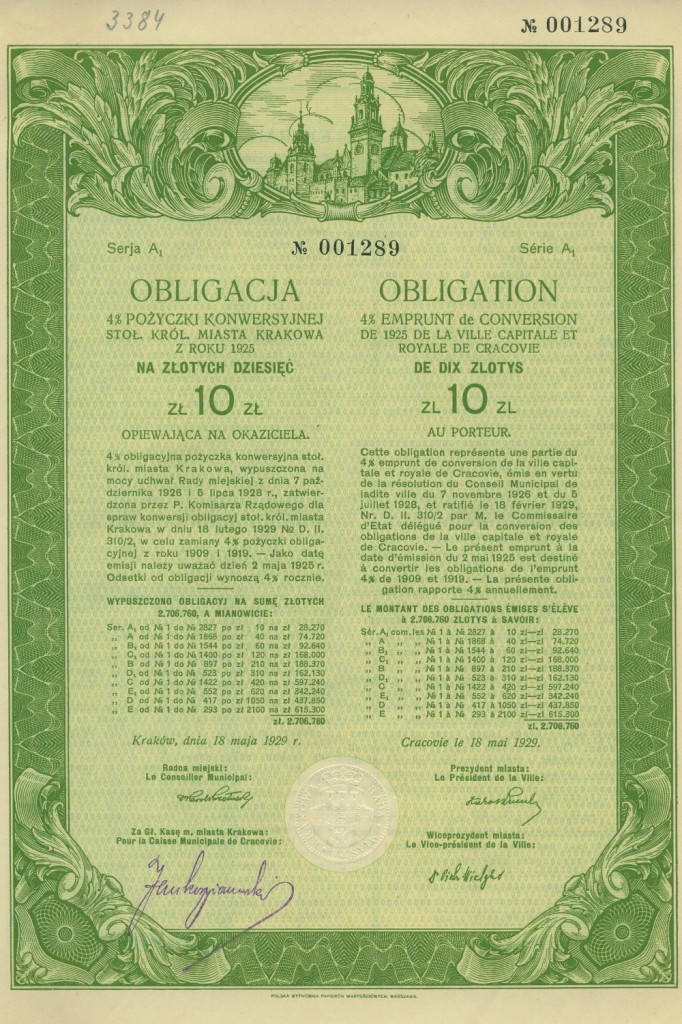

Also, when you do select your municipal bonds, please be very careful to look up the financial status of community issuing the bonds. There have been some cities or communities around the country that have filed bankruptcy. The best way to avoid getting caught in that trap is to do your due diligence and read everything about the specific community or entity that is issuing the bond and how it plans to pay it back.

And remember, you can find answers to all kinds of questions about tax-free income and other tax and business issues, free. Where? Where else? At www.TaxMama.com.

[Note: If you were subscribed to the e-mailed version of TaxQuips, you’d be getting other exciting news and tips by e-mail, that never appear on the site. Please click on the join TaxMama.com link – it’s free!]Please post all Comments and Replies in the new TaxQuips Forum .