NEWS FLASH!

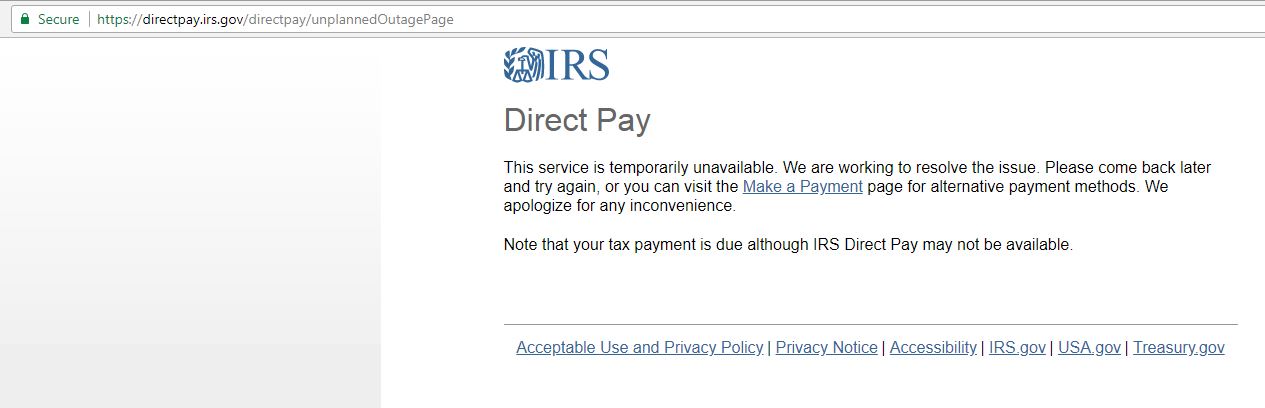

Don’t panic. Breathe – you get one more day #TaxDay – because the IRS system was down today

https://www.cpapracticeadvisor.com/news/12408362/irs-adds-one-day-to-tax-deadline-now-april-18-2018

Today is the tax return (or extension) filing deadline.

The IRS’ entire electronic system is DOWN!

Keep an eye on this page to see when it goes back up.

Meanwhile, you cannot efile your tax return or your extension.

Even the Direct Pay system doesn’t work.

If you have to file on paper (your tax software can’t file either),

Get your forms postmarked TODAY!

Form 4868 for personal extensions

Form 1040 ES for Personal Estimated Tax payments

Form 7004 for corporation(1120) and estate and trust extensions (1041) – use this for 2017 payments, as well

Form 1120W for Corporation Estimated Tax Payments – for 2018

Wow! April is such an expensive month. So many payments are due, who has the money to cover it all? Let’s look at the all the things we have to pay this month – and how to ease the financial impact, if possible.

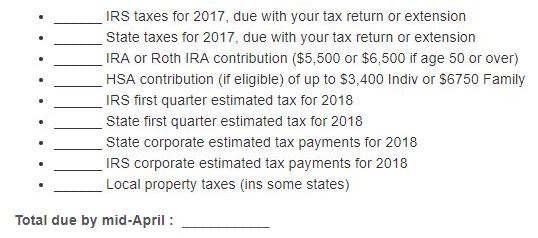

In the worst of all possible worlds, these are the bills you just might have coming due by the middle of April (fill in your own amounts here):

That’s a lot of money to come up with at one time.

Suppose you fill in the amounts on the above list and simply can’t come up with it all? Your money won’t spread to cover all those bills.

What can you do?

What MUST be paid by mid-April or else you lose the opportunity to get the benefit? Consider using your funds in this order:

IRA contributions. If you can’t fund those by April 17th for 2017, you don’t get the deduction on this year’s tax return at all. So, fund the IRA. To a person in the 25% bracket (plus 5% state), a $5,500 contribution is worth a $1,650 reduction of last year’s taxes.

HSA contributions. If you qualify for a Health Savings Account or Arrangement and have only partially funded the account (or not at all), you can contribute up to $3,400 for an individual account or $6750 for a family account. [Special tip to increase the total annual deduction – He can get an family account for himself and the children ($6750) and she can get an individual account ($3400) for a total contribution/deduction of $10,150.]

Property taxes. Depending on where you live, your property taxes are due by April 10th or thereabouts. Paying late will result in penalties ranging from one percent to 10% or more. Neglected long enough, this can lead to a lien sale of your home. Folks who always have trouble coming up with the two annual lump sums, should consider having the taxes impounded and added to the monthly mortgage payment. While paying a portion of the taxes and insurance each month raises the monthly payment; it also avoids the frantic scrambling when the bills come due.

What about all the income taxes?

Believe it or not, when you owe IRS or your state a lot of money, you’re better off paying the current year’s estimated taxes first. So allocate the next sums to your estimated tax payments.

Why? Because when you request an installment payment for last year, the first thing the tax authorities do is check if you’re in compliance with this year’s taxes.

If you still have some money, pay the current year’s state taxes. They usually aren’t nearly as much as your federal taxes.

Good news. The current year’s IRS taxes might be deferred for 6 months if you are facing a serious financial hardship. File Form 1127 by April 17th to get this extra time to pay, without incurring penalties. However, when you send in your extension of time to file, via Form 4868, send in at least $50 or so, even if you can’t pay the full amount due. When you use IRS’ Direct Pay to pay the extension fee – and it automatically files the extension. Incidentally, be sure to show the real amount you expect to owe on line 4, or the extension won’t be valid.

Naturally, if you aren’t facing a hardship, but don’t pay all your taxes by April 17th, your penalties aren’t waived. Is that a big problem? The IRS penalties and interest are probably cheaper than your credit card charges – unless you have excellent credit. The total hit is 5% for the 6 months. (With an extension of time to file, the penalties are half a percent per month underpayment penalties plus 4% annual interest.).

You have great credit? Excellent. Use your credit card to pay all the taxes. At least if you miss a payment, you won’t have IRS or the state breathing down your back or attaching your bank account. There are a few ways to do this:

1) Use the e-pay option when you file your tax return electronically. Depending on which service you use with your electronic filing, the convenience fee will be around 2%.

2) Using one of your credit card service’s checks or direct payments (call customer service). The interest rate on those special checks can be as low as 0%. But beware of the cash advance fees! Those range from 2% of the amount borrowed to 5% or more. With cash advance fees like this, the online payment option might be lower.

3) If you don’t have checks and don’t like the way your credit card handles the transfer payments, you have another option. Get a cash advance deposited directly in your bank account. (That can take about two weeks.) Pay by check from that cash advance. Again, shop for the best interest rate, zero if possible, and the lowest cash advance fees. Sometimes, you can even get the 0% rate for 18 months. So shop around! And do your best to get rewards points!

4) Use your home equity line of credit (HELOC). This might be a higher rate than your credit card. But there are no cash advance fees. You won’t be able to deduct the interest on this loan anymore. Not since the latest Tax Cuts and Jobs Act. And, of course, mortgaging your home to pay your taxes, is the least desirable option.

No credit and no money?

Both the IRS and your state offer installment agreements. IRS has made them easier to get, but they do charge a fee. The fee is lower if the payments come directly from your bank account. Personally, I would avoid owing money to the IRS or state. They can be harsh when you miss a payment.

Instead, file an extension on your tax return as instructed above. Pay as much as you can afford with the Form 4868. This will give you 6 months of breathing room before anyone starts any collections actions.

Meanwhile, start saving up money. Perhaps you may want to pick up a part-time job in order to avoid racking up any debt at all. Or, if you’re in business, hold a special sale to raise the money. Many Internet entrepreneurs call them “tax sales.”

And if you have enough available cash as a result, you might even be able to reduce last year’s taxes by funding a pension plan. (Yup, there are ways!)

Finally, file your tax return in October, paying as much as you have raised or saved up.

If you still have a balance due, you can wait for the notice from IRS. It will take about two months to arrive. Pay what you can. Then, if you still owe money and expect to be able to pay off the balance within 60-120 days, just call IRS and ask them to put a hold on collections actions – and pay off the balance before that deadline. You will have saved yourself a fee, and your bank account won’t be attached by the IRS or state.

Naturally, if your taxes are much higher, you will need an installment agreement or offer in compromise. So start that process early.

Tough time require stronger money management skills. A little budgeting and impulse-buying resistance training can help you reduce your taxes AND free up more money than you realize.

Eva Rosenberg, EA is the publisher of TaxMama.com , where your tax questions are answered for free. Eva is the author of several books and ebooks, including Small Business Taxes Made Easy. Eva teaches tax courses at IRSExams.school and CPELINK.