It’s TaxQuips time from TaxMama.com®. Today TaxMama® wants to talk to you about the nervous breakdown your tax professional is about to have. And why. Dear Family, I am extremely alarmed by what I am reading and seeing from the tax professional community – at all levels. From the […]

Category Archives: Legislation

Wow, an entire month has just flashed by. We’ve been buried in work at our office – how about yours? Dear Family, The 2020 tax return filing brings lots of questions, a certain amount of uncertainty, and for many Americans, a surprise balance due. (You didn’t realize […]

We have legislation pending today – which might actually go through! Dear Family, Until some of the data released this morning, I didn’t think the new budget legislation was going to have any impact on our 2020 tax returns…but there are strong hints that aside from additional […]

TaxMama® wants to bring some pending and potential tax legislation to your attention, today. Dear Family, On June 14th, I told you about the Taxpayer First Act that was waiting to be signed by the President. He signed that bill into law on July 1st. But there is still a lot that needs to be […]

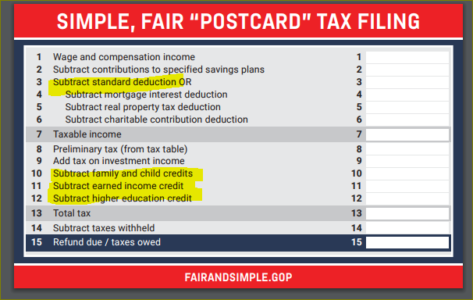

https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard. The bad news? Look at lines 3, 10, 11, and 12. Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality. It should be a required […]

Dear Family, It’s nice to get a few days off, isn’t it? In honor of Earth Day, Arbor Day and all that, we went camping in the desert to see the spring blooms before they burn out. Coincidentally, it turns out that National Park System is offering free admissions this week – through tomorrow. So […]

Courtsey of IRS Under the Hiring Incentives to Restore Employment (HIRE) Act, enacted March 18, 2010, two new tax benefits are available to employers who hire certain previously unemployed workers (“qualified employees”).

Dear Family, This week is Passover and Easter Week. We’ve been dark for a couple of days due to the holy days. So you didn’t get TaxQuips podcasts on Tuesday and Wednesday. Don’t worry, it’s not your mail server. Southern California has been getting storm warnings from our meteorologists all week. Yet, mornings still dawn […]

Dear Family, The phones have been ringing all morning. Usually, Friday mornings I get to work quietly to prepare this for you early in the morning (at least here, on the West Coast). Last night and early this morning the wind blew away all the smog. This dawned gloriously in California with the sun gleaming, […]

Today TaxMama hears from CJ in Concord, California has an urgent request. “Time is short on this one! Do you have any information about a bill being put before the California legislature tomorrow – (June 22) that would allow the state to have 3% in taxes withheld from payments to independent contractors, independent distributors, etc.? […]

Today TaxMama hears from Betty in North Carolina, who wants to know.https://theteacherpreneur.com/wp-content/languages/new/custom-research-paper-writing.html “Are Social Security recipients going to receive anything from the Obama recovery package?”

Today TaxMama hears from Shirley in Florida who had a thought. “If the government has $750 billion to get this economy going again—would it not be simpler and quicker to give lets say 250 million taxpayers (out of a population of maybe 300M) $3,000 each to spend any way they like? We then protect the […]

- 1

- 2