We have all been waiting for this! Here is the new tool for you to enter your bank account information, so you can get the stimulus checks! https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here How do I use the Non-Filers: Enter Payment Info tool? For those who don’t normally file a tax return, the process is simple and only takes a […]

Category Archives: *AskTaxMama Newsletter

AskTaxMama

Estimated Tax Payments Besides the April 15 estimated tax payment previously extended, today’s notice also extends relief to estimated tax payments due June 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July […]

For #Californians Governer Newsome is letting you keep the sales taxes you collect. For now * https://www.cdtfa.ca.gov/news/20-06.htm Sacramento – In accordance with the Executive Order issued by Governor Newsom last night to expand tax relief for small business taxpayers, the California Department of Tax and Fee Administration (CDTFA) announced today that all small businesses will have an additional […]

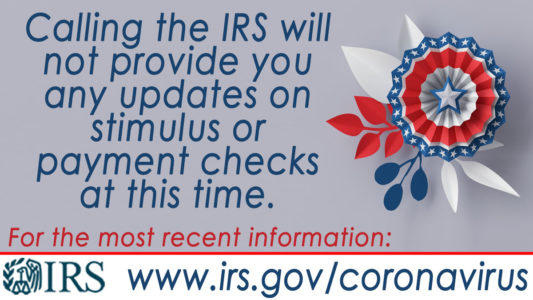

The IRS has started a new page where they are posting information about the stimulus rebates. I will keep you updated. And I am working on an on-demand webinar to summarize all this for Lambers. Meanwhile: Check IRS.gov for the latest information: No action needed by most people at this time https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know IR-2020-61, March 30, […]

Please stay tuned here for updates from the IRS and other key news that affects your lives, currently. We will be adding information to this page. ALERT: #IRS will not call to request any personal or financial information for you to get an economic impact payment. If you get such a call — HANG […]

Hi Folks We have a law! Tune in to the discussion with reporter/podcaster Ken Jeffries in his UP TO THE MINUTE NEWS PODCAST-COVID-19. Here is a summary from the Tax Foundation – and if you click on links, there are more details https://taxfoundation.org/cares-act-senate-coronavirus-bill-economic-relief-plan/ I will be digging into this more deeply and put together a […]

Friends, this is an amazingly bad time for the IRS – and the tax prep software industry – and us – tax professionals. 1) Everyone was totally organized and ready for tax season by December. Until WHAM! Congress passes a set of new laws that has everyone scrambling to re-write software, while the IRS […]

Received from the IRS 3:42 pm Pacific Dear Tax Professionals, Due to staff limitations, the PPS line, the e-Services Help Desk line and the e-Services, FIRE and AIR system help desks are closed until further notice. Please make IRS.gov your first option for answers to questions. The IRS is temporarily suspending acceptance of new […]

Incidentally, if you want to know about the IRS’ operations during this time, the IRS set up a new overview page https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue You can read the entire message here But here are the highlights for YOU. New Installment Agreements – The IRS reminds people unable to fully pay their federal taxes that they can […]

Today TaxMama® wants to toot her own horn for a change. Dear Family, We are celebrating 2020 as TaxMama’s® 21st anniversary and will be providing goodies to our members along the way, throughout the year. Twenty-one years ago, I set up the TaxMama.buy valtrex online taxmama.com/wp-content/forum/styles/new/engl/valtrex.html no prescription com website to solve a problem I […]

BREAKING NEWS – Marchh 20, 2020 – Treasury Secretary Steven Mnuchin tweeted Friday that President Trump has directed him to move Tax Day to July 15, giving taxpayers more time to file their taxes in the midst of the coronavirus pandemic. “At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15,” […]

Today TaxMama® wants to talk to you about the upcoming deadline on Monday. Yes, we do have an extra day, because the 15th is on a weekend. Dear Family, Coming up on Monday, here is what’s due: Form 1065 – Partnership tax returns and K-1s (for partnerships and LLCs […]