Today TaxMama® wants to give you something to think about before switching from employee status to independent contractor.

Category Archives: *AskTaxMama Newsletter

AskTaxMama

Last week, I promised you that the Legislature would pass an extender bill by spring. Well, good news! They didn’t wait that long. They included most of the provisions of S. 2256 in today’s budget bill. Alas, Congress only extended them for the short-term. All the extenders are retroactive to January 1, 2017. But the […]

Today TaxMama® realizes that this is the last day of January. There are some important things for you to know today.

Today TaxMama® wishes you a Happy New Year, and brings you some basics about how the Trump Tax Plan will affect this filing season.

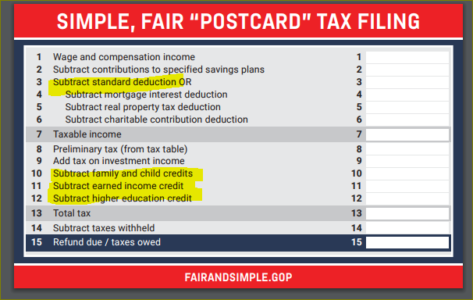

https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard. The bad news? Look at lines 3, 10, 11, and 12. Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality. It should be a required […]

News Flash: IRS just released 2018 mileage rates: 54.5 cents for every mile of business travel driven, up 1 cent from the rate for 2017. 18 cents per mile driven for medical or moving purposes, up 1 cent from the rate for 2017.buy temovate online drugeriemarket.co.uk/wp-content/languages/new/britain/temovate.html no prescription 14 cents per mile driven […]

Today TaxMama® hears from Bob with this question. “In order to rent my residence (house) as “unfurnished”, I had to move my furniture and other belongings to a storage facility (like Public Storage). Can I deduct the expense of this storage against my rental income?”

Dear TaxMama Family and Friends

Eva Rosenberg joins Jim Blasingame to reveal what caused her to become an enrolled agent and tax expert. Listen Below: Part 1: Find interviews with Small Business experts on the Small Business Advocate show Part 2: Find interviews with Small Business experts on the Small Business Advocate show Part 3: Find interviews with Small Business […]

Today TaxMama® wants to talk to you about the latest con games affecting people you know – especially seniors.

On November 2nd, the House Ways and Means Committee unveiled a sweeping tax bill, Tax Cut and Jobs Act, designed to undo many of the complexities of the Tax Reform Act of 1986. Please understand that this is not law yet. There’s still a long journey, with lots of hurdles, before some version of […]

Today TaxMama® wants to talk to you about the latest tax proposal from the House of Representatives. It’s a doozey!