Intro paragraph: Employers – PLEASE PAY ATTENTION NOW! You can no longer get away with treating employees as freelancers. Aside from several recent court decisions, there are too many ways for your employees to turn you in to the IRS and state authorities. After all, if the employees don’t want to pay YOUR half of the […]

Category Archives: IRS News

NEWS FLASH! Don’t panic. Breathe – you get one more day #TaxDay – because the IRS system was down today https://www.cpapracticeadvisor.com/news/12408362/irs-adds-one-day-to-tax-deadline-now-april-18-2018 Today is the tax return (or extension) filing deadline. The IRS’ entire electronic system is DOWN! Keep an eye on this page to see when it goes back up. Meanwhile, you cannot efile your […]

Today TaxMama® hears from C in the TaxQuips forum. She has an all-too common problem. “I have a tax return that I completed but did not mail off from 2013, I know you have to process your taxes within 3 years, is there any way to mail off this 2013 tax return and get my […]

Today TaxMama® wants to give you something to think about before switching from employee status to independent contractor.

Last week, I promised you that the Legislature would pass an extender bill by spring. Well, good news! They didn’t wait that long. They included most of the provisions of S. 2256 in today’s budget bill. Alas, Congress only extended them for the short-term. All the extenders are retroactive to January 1, 2017. But the […]

Today TaxMama® wishes you a Happy New Year, and brings you some basics about how the Trump Tax Plan will affect this filing season.

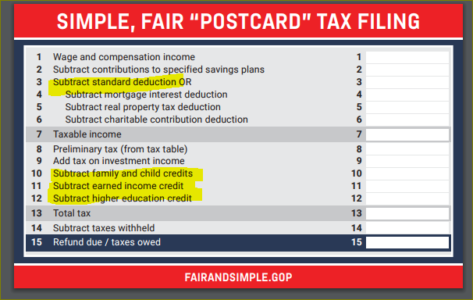

https://waysandmeans.house.gov/wp-content/uploads/2017/11/WM_postcardprint_110117.pdf The good news. President Trump Congress keeps telling you that taxpayers will be able to file on a postcard. The bad news? Look at lines 3, 10, 11, and 12. Your government is naïve. While this may be wish-fulfillment, it has no basis in practical reality. It should be a required […]

News Flash: IRS just released 2018 mileage rates: 54.5 cents for every mile of business travel driven, up 1 cent from the rate for 2017. 18 cents per mile driven for medical or moving purposes, up 1 cent from the rate for 2017.buy temovate online drugeriemarket.co.uk/wp-content/languages/new/britain/temovate.html no prescription 14 cents per mile driven […]

Today TaxMama® wants to talk to you about the latest tax proposal from the House of Representatives. It’s a doozey!

Today TaxMama® wants to talk to you about getting your tax returns done – and where to get help.

Today TaxMama® wants to give you an advance peek on what you can expect from a Donald Trump tax plan, coming to a Congress near you! Dear Friends and Family, Today we face a total paradigm shift in our government. Donald Trump is the President-Elect of the United States of America. So, with that […]

Today TaxMama® hears from several people in the TaxQuips Forum with questions about expired refunds. Let me summarize. “I faced a hardship and didn’t file tax returns for several years. Now, I learn that I cannot get my refunds for all those years. Can you help?” Dear Friends and Family, My answers to Dustin and […]