IRS operations to process third-party authorizations are now closed. Please do not fax requests for Centralized Authorization File (CAF) numbers until further notice. The Income Verification Express Service also is temporarily on hold. Possible alternative for tax administration purposes: clients can go to Get Transcript Online, create an account to verify their identities and immediately review […]

Category Archives: IRS News

We have all been waiting for this! Here is the new tool for you to enter your bank account information, so you can get the stimulus checks! https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here How do I use the Non-Filers: Enter Payment Info tool? For those who don’t normally file a tax return, the process is simple and only takes a […]

Estimated Tax Payments Besides the April 15 estimated tax payment previously extended, today’s notice also extends relief to estimated tax payments due June 15, 2020. This means that any individual or corporation that has a quarterly estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July […]

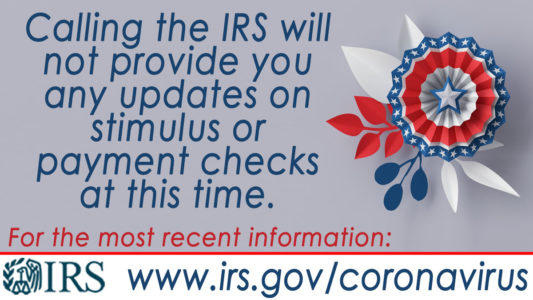

The IRS has started a new page where they are posting information about the stimulus rebates. I will keep you updated. And I am working on an on-demand webinar to summarize all this for Lambers. Meanwhile: Check IRS.gov for the latest information: No action needed by most people at this time https://www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know IR-2020-61, March 30, […]

Please stay tuned here for updates from the IRS and other key news that affects your lives, currently. We will be adding information to this page. ALERT: #IRS will not call to request any personal or financial information for you to get an economic impact payment. If you get such a call — HANG […]

Hi Folks We have a law! Tune in to the discussion with reporter/podcaster Ken Jeffries in his UP TO THE MINUTE NEWS PODCAST-COVID-19. Here is a summary from the Tax Foundation – and if you click on links, there are more details https://taxfoundation.org/cares-act-senate-coronavirus-bill-economic-relief-plan/ I will be digging into this more deeply and put together a […]

Friends, this is an amazingly bad time for the IRS – and the tax prep software industry – and us – tax professionals. 1) Everyone was totally organized and ready for tax season by December. Until WHAM! Congress passes a set of new laws that has everyone scrambling to re-write software, while the IRS […]

Received from the IRS 3:42 pm Pacific Dear Tax Professionals, Due to staff limitations, the PPS line, the e-Services Help Desk line and the e-Services, FIRE and AIR system help desks are closed until further notice. Please make IRS.gov your first option for answers to questions. The IRS is temporarily suspending acceptance of new […]

Incidentally, if you want to know about the IRS’ operations during this time, the IRS set up a new overview page https://www.irs.gov/newsroom/irs-operations-during-covid-19-mission-critical-functions-continue You can read the entire message here But here are the highlights for YOU. New Installment Agreements – The IRS reminds people unable to fully pay their federal taxes that they can […]

BREAKING NEWS – Marchh 20, 2020 – Treasury Secretary Steven Mnuchin tweeted Friday that President Trump has directed him to move Tax Day to July 15, giving taxpayers more time to file their taxes in the midst of the coronavirus pandemic. “At @realDonaldTrump’s direction, we are moving Tax Day from April 15 to July 15,” […]

I am from the IRS and I am here to help you! The intention, believe it or not, is to help small businesses that start to get behind on payroll tax deposits – before they get so far behind that it’s too late to save the business. The fact is, one of the most common reason that small businesses fail (other than ineptitude, bad planning and lack of funds) is that the owner thinks it’s OK to use the money withheld from employees’ paychecks to pay their own bills, as a short-term loan. It might work once. But payroll after payroll, the boss starts getting more behind. The funds don’t get paid back. The payroll taxes don’t ever get deposited. This affects the employees, trying to get their refunds. This often causes businesses to go under.

Today TaxMama® wants to give you news and some steps to take before the end of 2019. Dear Family, In the tax world, we spent this year trying to understand how to interpret all sorts of provisions of the Tax Cuts and Jobs Act that was passed at the last minute […]