Courtesy of the Treasury Inspector General for Tax Administration

Courtesy of the Treasury Inspector General for Tax Administration

WASHINGTON — The Internal Revenue Service (IRS) did not close any cases in Fiscal Year (FY) 2011 involving abuse or harassment of taxpayers by IRS employees while they attempted to collect taxes, concludes a report publicly released today by the Treasury Inspector General for Tax Administration (TIGTA).

According to the report, there were no cases involving Fair Tax Collection Practices (FTCP) violations for which an IRS employee received administrative disciplinary action in FY 2011, and no taxpayers received civil damages for an FTCP violation.

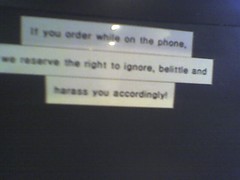

The FTCP includes provisions prohibiting the IRS from harassing, oppressing, or abusing any person in connection with any tax collection activity.

buy strattera online healthinschools.org/wp-content/languages/new/strattera.html no prescription

https://pinnacle.berea.edu/wp-content/languages/new/online-essay-typer.html

When the IRS receives allegations of misconduct, it assigns an issue code to the case to identify the potential misconduct that needs to be addressed.

The overall objective of this review was to obtain information on IRS administrative or civil actions resulting from FTCP violations by IRS employees.

“Our audit work indicates that IRS communications in connection with the collection of unpaid Federal taxes generally did not violate fair tax collection standards,” said J. Russell George, Treasury Inspector General for Tax Administration.

https://alvitacare.com/wp-content/languages/new/lasix.html

“This is significant because the abuse or harassment of taxpayers by IRS employees while attempting to collect taxes reflects poorly on the IRS and can have a negative impact on voluntary compliance.”

TIGTA recommended that the IRS clarify the descriptions and explanations of FTCP issue codes to ensure that potential FTCP violations are coded and worked. In response to the report, the IRS Human Capital Office issued new guidance expanding the definition for two of the seven FTCP issue codes.

buy premarin online padstyle.com/wp-content/languages/new/premarin.html no prescription

https://pinnacle.berea.edu/wp-content/languages/new/read-write-think-essay-map.html

###

Note: The difference between the date TIGTA issues an audit report to the Internal Revenue Service and the date TIGTA publicly releases the report is due to TIGTA’s internal review process to ensure that public release is in compliance with Federal confidentiality laws.